Can road carriers increase their tariffs while recovering from the COVID-19 crisis?

In a time when road transport is essential, transport rates have gone down. This means that road carriers are trying to cover their costs by any means. This is not a sustainable reaction. The rates for transport services and an eventual increase of the tariffs is only possible through a group reaction.

“When I was young, I had a yellow toy-truck. It made me stand out among the 6 year-olds of my building. That was until Santa Clause brought another kid a similar toy-truck, with a remote control… That was the first practical lesson I’ve got about competition: more-supply, less-visibility.”

A competitive market requires flexibility

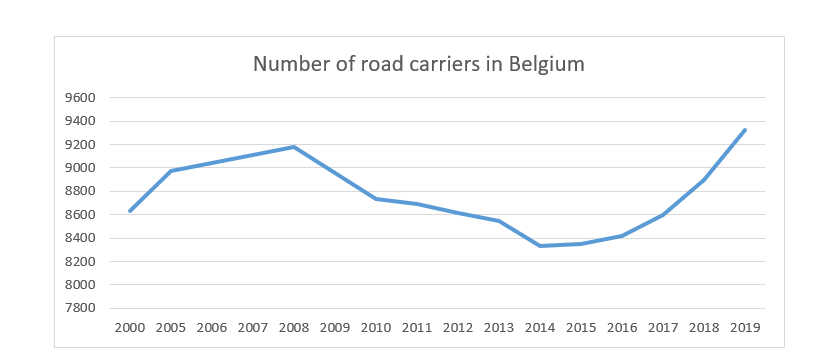

Road transport carriers operate in a highly competitive market together with many other (relatively small) players. In Belgium alone, there are more than 9000 road transport companies, more than 80% of them are small and medium size enterprises (SME). These SME’s are usually sub-contractors of the bigger ones.

“I ask myself, how flexible is every company’s choice in setting its tariff? Keeping in mind that these choices can always backfire on all…”

Source: Febetra (2020), https://febetra.be/infotheek/cijfers-de-sector/

The impact of freight exchange platforms is enormous

In the EU, there are over 30 international freight exchange platforms. The services offered by these platforms range from communication channels similar to discussion forums, freight planning, cargo/truck booking or auctioning, to more advanced services.

“Hence, this discussion on tariffs is also triggered by the question of why freight exchange platforms allow transport requests to be posted, regardless of their value? I have seen claims that fright rates went very low during the previous weeks.”

To give an example, recently a dispatcher accused a shipper on LinkedIn of offering a relatively low amount of money to have his cargo transported. Fellow dispatchers quickly reacted, saying that this practice is unacceptable and suggesting that the freight exchange platforms should ban these types of requests automatically.

However, having the freight exchange platforms setting limits on rates wouldn’t work. Freight exchange platforms are just administrators of a market place and do not intervene in the rate/tariff setting. It is similar to accusing the organizer of a second-hand market for letting sellers in with overpriced products.

How can this be corrected?

Low payments for transport can be corrected only by the reaction of the road carriers themselves, as a group. This is easier said than done. Road carriers operate in a very competitive market.

“There is a golden rule in the transport market: if you don’t accept a transport order fast, someone else will accept it in the next minute for 0.01 euro less”.

The road transport segment is the activity with the highest number of players. Due to this highly competitive market, many of these players have reached the situation where they are hardly breaking even. This type of behavior is suicidal and has a long-time effect on fellow road carriers.

The road transport segment is the activity with the highest number of players. Due to this highly competitive market, many of these players have reached the situation where they are hardly breaking even. This type of behavior is suicidal and has a long-time effect on fellow road carriers.

In theory, operating at a price that does not allow you to cover the costs is not sustainable for any business. Moreover, it creates a wrong premise on the market and it will take time before it’s corrected. Thus, other road transport carriers will be forced to accept alike offers (for low payments) to bridge certain periods. Yet, this bridging will get longer and longer, and it will end only when the market reacts as a group.

What can COVID-19 teach us about the group reaction?

The good news is that this group reaction can be given, by each service-segment individually. Taking a look at a survey conducted by two Belgian associations for road transport (Febetra and UPTR), we learn the following: the most affected service segment with a dramatic decrease in activity is the transport of vehicles (-82.30%), followed by exceptional transport (-58.70%), container transport (-37.37%), general cargo and logistics (-31.81%), and temperature controlled transport (-31,14%)[1].

- For the first two categories it is obvious that the market demand has ceased abruptly. The same has happened for activities that require specialized (oversized) equipment.

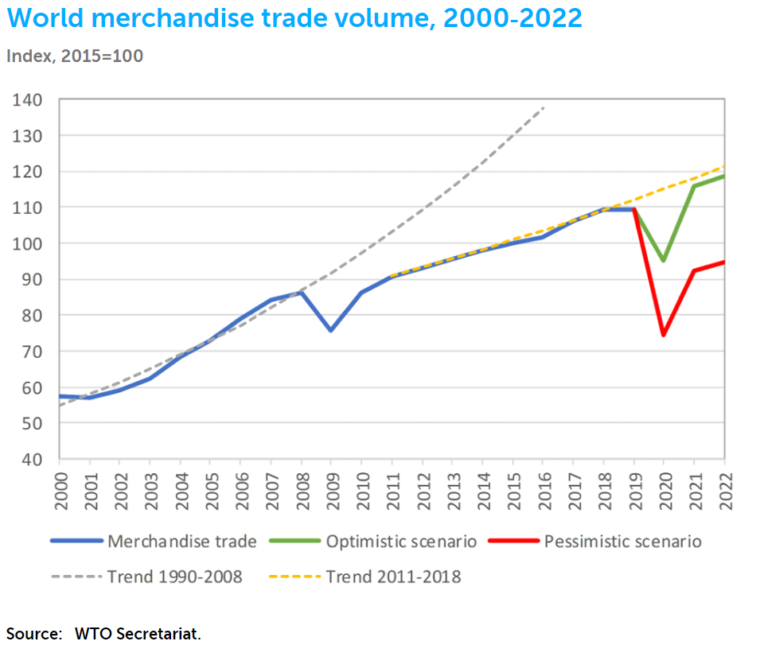

- Road transport carriers operating with specialized loading equipment are on hold. There is no reaction possible. In this segment, the small ones might suffer the most. The container transport still benefits from a delayed effect with regard to volumes, but effects are expected soon. The road transport of containers is pretty much dependent on the global freight market evolution. Hence, due to a drop in the world-wide production or a scarce supply of empty containers, the transport demands might be affected as well.

- The general logistics and temperature-controlled categories are the least affected segments. Road transport carriers active in the general and refrigerated cargo segment with relatively high demands, can give a reply to the market and increase their transport tariffs first.

“Every player active in this market segment should study this theory. The group reaction will have to happen (on the less-supply higher-prices principle). This is what COVID-19 taught us.”

[1] Transport Media (2020) https://transportmedia.be/2020/04/welke-impact-heeft-de-covid-19-crisis-op-de-transporteurs/wi

In addition, looking at the graph above from World Trade Organization (WTO) and acknowledging the voices predicting the COVID-19 crisis as being worse as the previous (2008-2009) economic crisis, it isn’t hard to guess how the curve with the number of road transport carriers will evolve next years in Belgium. I expect a lot of acquisition from big enterprises and higher use of digital tools.

Instead of a larger conclusion, I would say that there is hope for recovery. The group reaction will matter most. Last but not least, don’t forget that, besides tariffs, the level of service is an important element in transport services, so keep up the good work.

More information about the research activities of Valentin Carlan and his colleagues can be found on the web page of Transport and Regional Economics.